Cryptocurrency staking presents a groundbreaking opportunity for individuals to actively engage with blockchain networks while reaping the rewards of their participation. By delving into the world of staking, you can not only secure your investments but also contribute to network security and decentralization.

Cryptocurrency staking presents a groundbreaking opportunity for individuals to actively engage with blockchain networks while reaping the rewards of their participation. By delving into the world of staking, you can not only secure your investments but also contribute to network security and decentralization.

In the ever-evolving world of digital finance, cryptocurrency staking, and yield farming have emerged as two popular investment opportunities for those looking to earn a passive income on their tokens.

Both staking and yield farming can offer significant returns, especially if your coins are languishing in a wallet, while also providing important services to the crypto ecosystem.

However, as with any investment mechanism, there are certain risks attached to both these sources of additional income.

Here I’ll take a look at the pros and cons of staking and yield farming and the differences between them. I’ll also examine liquid staking – a hybrid of the two.

What is Cryptocurrency Staking?

Cryptocurrency staking has emerged as a popular method for individuals to earn passive income within the realm of digital assets. Staking involves holding a particular cryptocurrency in a digital wallet to support the operations of a blockchain network.

Unlike traditional proof-of-work mechanisms, which require miners to solve complex mathematical problems, staking allows users to validate transactions and create new blocks by locking up a certain amount of their chosen cryptocurrency.

Staking cryptocurrency is a special ‘consensus mechanism’ which is used to validate and secure different blockchains.

While blockchains such as Bitcoin are secured with Proof-of-Work (PoW) mining using vast arrays of dedicated ASIC computers, others use what’s called Proof-of-Stake (PoS), such as Ethereum.

With PoS, users ‘stake’ their cryptocurrency holdings to participate in the network’s transaction validation process, contributing to the network’s security and decentralization in the process.

In return, the owner of the staked crypto receives rewards in the form of additional pieces of the crypto they’ve staked.

How Does Cryptocurrency Staking Work?

At its core, cryptocurrency staking involves participants, often referred to as “validators,” contributing to the security and functionality of a blockchain network. Validators are required to lock up a specified number of coins as collateral, demonstrating their commitment to the network’s stability. In return for their contribution, validators have the opportunity to earn rewards in the form of additional cryptocurrency.

Staking rewards are typically determined by various factors, including the total amount of cryptocurrency staked, the length of time the coins are staked, and the network’s overall health. The more coins a participant stakes and the longer they are willing to lock them up, the higher their potential rewards. This incentive mechanism encourages users to actively participate in the network’s operations and maintain its integrity.

How much can I earn from staking crypto?

How much you earn will depend on the cryptocurrency you’ve staked, how long you’ve staked your coins for, and the network’s staking participation rate.

Staking rewards tend to be distributed on a regular basis depending on the specific blockchain protocol and are often shown as an Annual Percentage Yield (APY) figure.

This can range from single digital percentages to 20% APY or more depending on the token being staked.

As a rule of thumb, the more tokens you stake and the longer you commit them the greater the rewards.

What are the risks of staking crypto?

While staking offers some appealing rewards and is a great way to generate a passive income from your crypto, there are certain risks you need to be aware of.

They include:

Volatility and market risk. This is particularly true if your coins are in a locked staking situation where they’re illiquid and unavailable to trade if there’s a sudden market movement. This could see losses extended or profits missed.

Validator node errors. Validator nodes play a key role in validating crypto transactions and ensuring the integrity of the blockchain. As such, validator errors could lead to penalties or even the loss of your coins.

Hacking and theft. The platform you stake your crypto through could have vulnerabilities that are exploited by a cybercriminal to steal your staked coins.

What is yield farming?

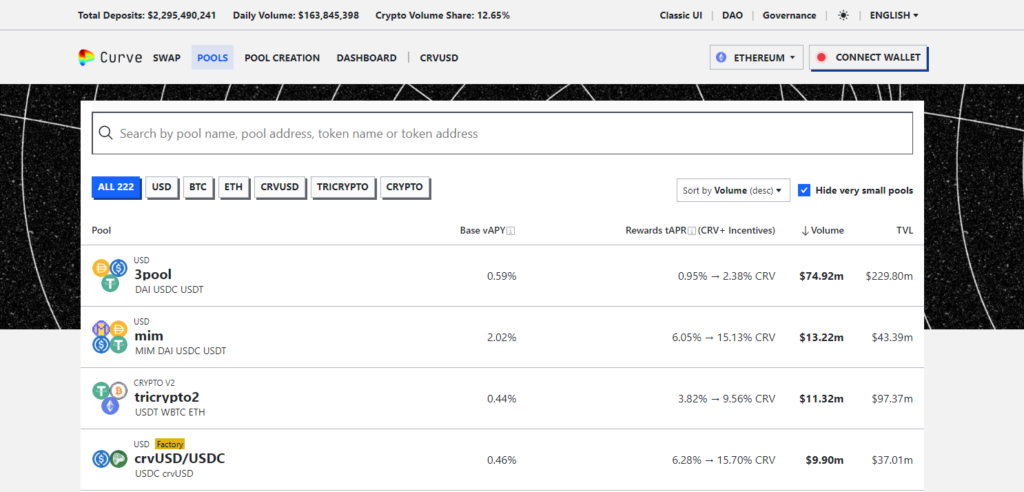

Crypto yield farming, also known as liquidity mining, is a decentralized finance (DeFi) opportunity that involves lending your crypto to decentralized platforms and exchanges (DEXs) to provide liquidity.

By adding your digital assets to liquidity pools, you help facilitate various financial activities within the DeFi ecosystem while earning rewards for doing so.

To participate in yield farming you need to use smart contracts in order to act as a liquidity provider (LP).

LPs facilitate seamless token swapping and lending and borrowing activities for other users.

How much can I earn from yield farming?

It’s possible to earn a significant return through yield farming depending on the size of the liquidity pool, the specific DeFi platform’s reward mechanism, and market conditions.

Some of the best returns can be found in high-demand liquidity pools or newly launched platforms where rewards might be offered in the form of governance tokens or other utility tokens.

As with staking, yield farming returns are usually presented as APYs, although these rates can fluctuate significantly due to the volatility in the crypto markets.

How much you’ll earn from yield farming depends on a number of factors, such as a token’s underlying performance, trading volume, and platform adoption.

What are the risks of yield farming crypto?

As with staking, the rewards for yield farming can be impressive but earning them is not without risk.

Some of the risks of yield farming include:

Impermanent loss. This occurs when the value of the staked crypto changes relative to the original investment.

Smart contract vulnerabilities. Hackers are constantly looking at ways to exploit smart contracts and there have been some high-profile breaches over the years. It’s important to exercise caution when choosing a platform.

The cryptosphere is awash with DeFi platforms and liquidity pools so make sure you choose platforms carefully.

Look for those with transparent governance mechanisms, active communities and robust security measures.

Diversifying your yield farming activities across multiple pools can also help manage risk effectively and mitigate against potential losses.

What’s the difference between staking and yield farming?

As we’ve seen, both staking a yield farming are two popular methods of earning a passive income from your crypto within the DeFi ecosystem.

While both strategies offer appealing earning opportunities, the way they actually work differs significantly.

Some of the key differences between staking and yield farming are:

Mechanism. While staking is a consensus mechanism that secures blockchain networks, yield farming is a DeFi practice that involves providing liquidity to decentralized platforms such as DEXs or lending protocols.

Rewards. In staking, users are given extra tokens from the same blockchain network while yield farmers receive rewards in various forms, such as fees, tokens from the DeFi platform they’re using, or entirely different tokens.

Liquidity. With staking there is often a lock-in period during which time your tokens are illiquid and cannot be traded. With yield farming, liquidity providers can usually withdraw assets almost instantly offering greater flexibility and avoiding market risk.

Risk. Staking is generally considered lower risk and a more conservative investment strategy compared to yield farming. While yield farming has the potential for higher returns, it’s considered riskier than staking.

Complexity. Staking is relatively straightforward and user-friendly, with many popular cryptocurrencies supporting staking. Yield farming however is more complex and requires a deeper understanding of DeFi protocols, liquidity pools, and market dynamics.

Liquidity staking

If you’re looking for a way to generate income from your crypto that combines both staking and yield farming, then liquid staking might be for you.

Liquid staking combines the benefits of both staking and liquidity provision in a single DeFi protocol.

Unlike traditional staking where your tokens are locked, liquid staking allows users to stake their cryptocurrency on a PoS network while maintaining the flexibility to use them to provide liquidity or even trade them.

With liquid staking users stake their tokens in a smart contract and in return they receive a tradeable representation of their staked tokens, often referred to as a receipt token or Liquid Staking Token (LST).

The LST can be then transferred, traded or utilized in DeFi to enable the user to benefit from both staking and yield farming at the same time.

What are the risks of liquid staking?

Because liquid staking activities are carried out using smart contracts, there’s the risk that a vulnerability in a faulty smart contract will be exploited by hackers.

With liquid staking, your assets are in the hands of a third party meaning there’s the potential for what’s known as counterparty risk which is when another party in an investment defaults on their part of the deal.

Liquid staking can also be impacted by low liquidity when the Total Value Locked (TVL) in a liquidity pool falls below a certain level.

This can cause the token to lose its peg – known as de-pegging – which in turn can lead to high slippage rates when users are transferring holdings between different tokens.

Ultimately this has the potential to leave you unable to sell your crypto assets which in turn creates the potential for significant losses.

Final word

As with any financial investment, it’s vital that you do your own due diligence and understand the risks before committing your cryptocurrency or cash.

When it comes to staking, yield farming, and liquid staking you need to thoroughly research different platforms to ensure you select one that is secure, has a good track record, and a transparent fee structure.

You also need to consider your appetite for risk and technical/financial knowledge when deciding which is the best crypto investment strategy for you.

As such, you should approach this type of crypto investment activity with a cautious and well-informed mindset and understand the risk involved.

However, you can potentially increase your wealth with a bank beating APY if you select the right crypto investment opportunities.