BlackBull Markets Review: Is Blackbullmarkets.com Legit?

Not all forex brokers are scammers. Unlike the many scam brokers we have reviewed, we occasionally come across some legit ones. BlackBull Markets is one of them. The firm is based in New Zealand.

The firm’s use of the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms is one of its notable features. These platforms are frequently utilized in the foreign exchange market because of the variety of advanced trading tools they provide, such as technical analysis indicators, charting tools, and automated trading capabilities.

Regulated financial services providers have been authorized to offer forex trading services to clients by an oversight body. These governing bodies keep tabs on brokers to make sure they’re playing by the book.

Using a forex broker that is subject to government oversight has many advantages. Traders have an extra layer of security because of regulations. It verifies that the broker is working honestly and openly and has adequate funds to withstand the potential losses that can occur in forex trading.

Brokers that want to operate legally in the foreign exchange market must also keep customer money separate from company money. In the event of the broker’s insolvency, the client’s money would be safe and refunded to them.

Besides these safeguards, clients of registered forex brokers are also subject to regulations governing the way the broker conducts business. Internal controls and reporting standards help guarantee the honesty of their business dealings.

Traders should only work with a regulated forex broker to protect their money. There are a lot of unregulated brokers out there who might entice you with offers, but you should avoid them at all costs.

About Blackbullmarkets.com

The broker serves tens of thousands of traders in over 180 countries. They strive to make the trading experience better with time. With this broker, you can trade equities, forex, commodities, and CFDs on the best available platforms, including TradingView.

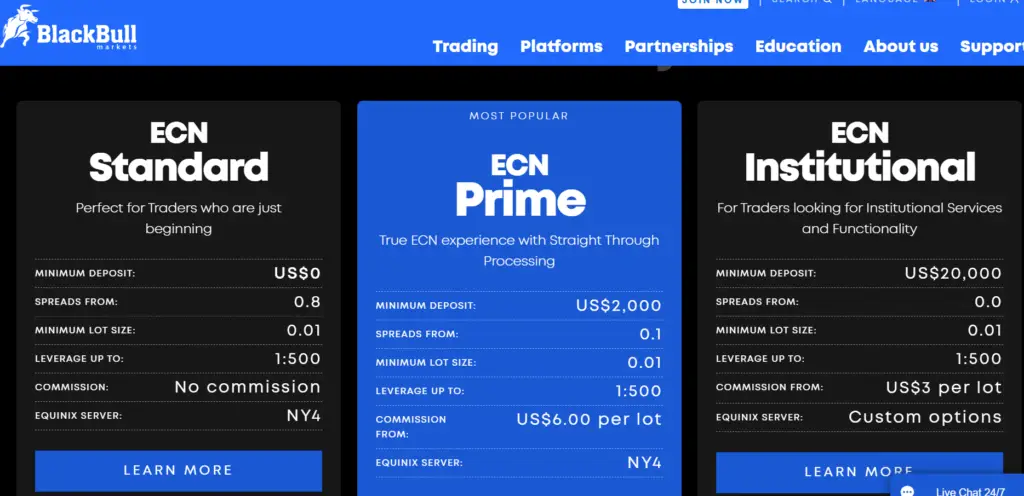

The broker has three account types. The most popular one is the prime ECN. Traders can, however, use the standard one with no minimum deposit.

The broker’s referral program rewards traders when they invite other customers. The trader can earn up to $250 if they refer another trader and they make a deposit. The person who was invited also gets some money in their account. The firm has, however, not explained if the trader can withdraw the money or if they can only use it to trade.

BlackBull Founders and Team

There is no information about who established the company. They only note that it was founded in Auckland, New Zealand. The founders came together in the retail equities market in 2014 with the intention of offering their customers an exceptional trading environment.

Telling a company’s story, beginning with its founders, is one way to earn a customer’s trust and establish credibility. Considering the importance of trust in the financial sector, this is of paramount importance.

BlackBull founders are frequently the best sources of knowledge about the company’s industry. By providing background on them, a forex broker can show that it is well-versed in the market.

Companies are led and guided largely by their founders. Customers will appreciate knowing more about the leaders and be more at ease with its direction if they have the background on the people behind its inception.

Some customers may be curious about the lives and goals of the company’s founders. Customers can feel more connected to and loyal to a brand if they are given background about their background.

Contact Details

The firm has given a physical address. They also have a phone number and an email. That way, if a trader has any questions, they can get in touch with the company through the available means.

It is essential to be able to contact your broker with any queries or problems you may be having with your trading account or platform. If you want to get in touch with your broker quickly and simply, they should give you a number of ways to do so, such as a phone number, an email address, and maybe even a chat feature.

Legit FX brokers are subject to oversight from government agencies. These organizations frequently ask brokers to disclose their contact information in a clear and correct format to ensure that they can reach them in the event of a regulatory issue.

Your broker may need to get in touch with you if there are any changes to your account, such as new terms and conditions or higher margin requirements. If your broker can’t do this, you should not trust them.

BlackBull Regulation Status

BlackBull is a regulated broker. Located at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles, the broker is a limited liability company incorporated and registered under the laws of Seychelles with company number 857010-1.

The provision of investment services by the company is licensed and regulated by the Financial Services Authority of Seychelles (“FSA”) under license number SD045. We checked the FSA database and confirmed that the company is registered.

In addition, the brokerage adheres to a stringent Anti-Money Laundering (AML) / Counter Financing of Terrorism (CFT) policy, guaranteeing that it conducts all operations lawfully and morally.

The broker is committed to adhering to a strict code of ethics and a rigorous set of operational standards. It is necessary for each financial institution to have a well-designed supervisory structure that actively safeguards traders and dictates the conduct of service providers.

Traders can file a complaint with the Representative Office if it includes the Compliance Officer; otherwise, the Compliance Officer will handle it if it is different.

We also checked the Financial Markets Authority (FMA) of New Zealand to see if the company is registered. Indeed it is licensed as a derivatives issuer. Traders can therefore verify the legitimacy of the company to clear any doubts.

Trading Conditions

BlackBull has floating spreads because it is an STP/ECN broker. The spread for major pairs like EUR/USD starts at 0.9 pips on the Standard account type. This account also has zero commission.

The leverage is 1:500. This is relatively high because many brokers in New Zealand offer a leverage of up to 1:200. In the UK, brokers can give a maximum of 1:30 leverage. High leverage allows traders to control a considerable amount of money. However, they can also lose much in case a trade goes against them.

BlackBull Deposit and Withdrawal

Traders can use Skrill, Bank Transfer, VISA, MasterCard, Union Pay, or Neteller to deposit and withdraw from the broker. These are convenient means of transacting. This is unlike the shady brokers who use cryptocurrencies for such transactions.

Trading with a regulated broker ensures the security of funds. Many licensed brokers also show evidence of traders who have deposited and withdrawn money from their trading accounts. They also provide a comprehensive financial report.

Unfortunately, this broker has not provided this data. This is not, however, enough to mean they are scams. This is because not all financial regulators demand that brokers make this data available.

Final Verdict

BlackBull Markets is a regulated forex broker. The firm offers services to many people in the world. This is one of the many regulated forex brokers in the market that traders can work with. Although the broker has not provided information about its founders, it is legit.

There are still, however, many scam brokers out there. Traders must do their research to know if a broker is trustworthy. A legit broker should be transparent and must be licensed by regulatory bodies. This way, traders can rest assured their money is safe.

Don’t let the mistake of investing in an unauthorized platform like Geetle.com ruin your financial future. We can help you take the necessary steps to recover your funds and move forward. Our team is available 24/7 to answer any questions you may have and to provide the support you need.