AXOFA Review: Avoid Axofa.com an Offshore Firm

As an offshore broker, it has many telltale signs of a scam. The company offers many good trading conditions. However, some of them are too good to be true. To make money in forex trading, you should always work with honest forex brokers. AXOFA is an offshore broker based in Saint Vincent and the Grenadines (SVG

Thanks to the expansion of the internet and the development of sophisticated online trading platforms, foreign exchange trading has seen explosive growth in recent years. Previously, only large banks and financial institutions had access to the forex market. Today, however, anyone with access to the internet can participate.

One factor fueling the market’s expansion is the rise of retail traders. High liquidity and margin trading allow these investors to control sizeable positions with minimal capital investment. In addition, retail traders now have an easier time entering the market because of the low transaction costs and the abundance of free educational resources..

High leverage can bring in big bucks if you know what you’re doing, but it can wipe you out just as quickly if you’re not a pro. Scam brokers may employ excessive leverage to attract inexperienced traders, who they subsequently take advantage of by manipulating the market.

In general, both investors and authorities are worried about fraudulent forex trading brokers. Traders can avoid falling prey to these cons and instead concentrate on finding financial success in the foreign exchange market if they exercise due diligence and acquire relevant knowledge.

About Axofa.com

We gathered a few things about the broker from their website. The company markets itself as an international broker where you can trade currencies, CFDs, commodities, indices, and stocks.

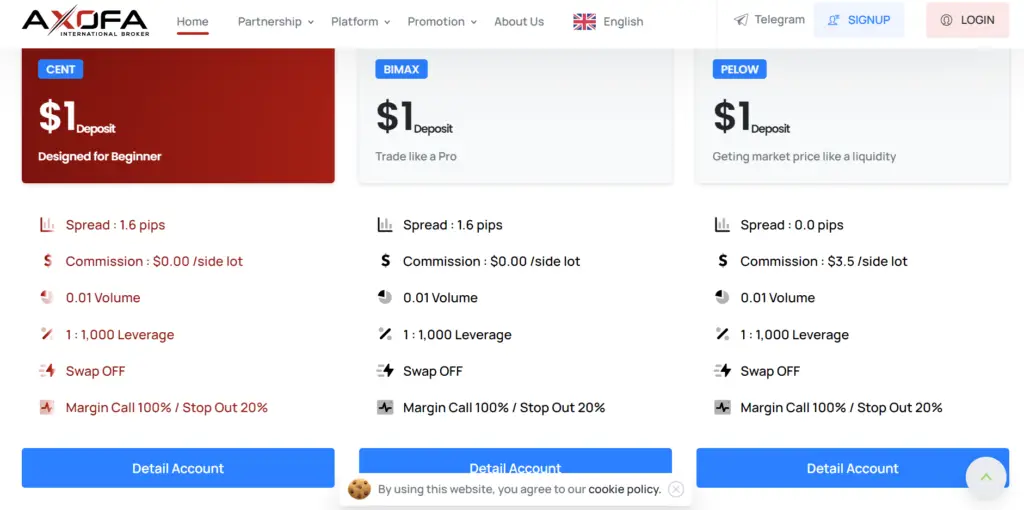

The firm offers three types of accounts, each with its conditions. From our observations, some accounts seem to be designed only to lure traders. For example many novice traders would be attracted by the welcome bonus the broker gives. Many regulators however prohibit this practice.

Forex’s meteoric rise can also be attributed to the proliferation of automated trading systems like bots. Algorithms are used in these systems to examine market data and make trades based on established guidelines. Because of automated trading systems, investors can take advantage of market fluctuations whenever they occur, regardless of whether or not they are physically near their computers.

The proliferation of online forex trading has coincided with a surge in the number of fraudulent brokers. Online scam brokers prey on their victims by making false promises of high returns, refusing to disclose any costs or commissions, and rigging trading platforms in their favor.

Scam forex brokers frequently use high leverage, which is the ability to trade with a significant sum of money in relation to the size of the account, as a means of luring in unsuspecting investors

AXOFA Founders and Team

The broker is silent on the issue of company founders. We could not even establish when it was started. It has not even mentioned the employees or the current leaders. Hiding such information only proves they are dubious brokers. Legit firms are proud of their employees and founders.

There are a variety of explanations for why fraudulent brokers could try to conceal details about their top executives and staff. One is so that authorities and regulators have a more challenging time identifying and tracking them down.

Scam broker companies dodge responsibility for their clients’ losses and legal action by keeping their owners’ identities secret.

Contact Details

AXOFA has given a phone number, email, and physical address. Traders can therefore reach them. However, given the shady nature of the broker, this information might be misleading.

Every responsible forex broker must give valid contact details. Giving out contact information is a great way to be more open and earn your customers’ trust. It demonstrates that the broker is not trying to hide anything from their customers and is transparent and approachable.

Customers who have access to the broker’s contact information can reach out to them with any inquiries or concerns they may have. Traders in the often-chaotic foreign exchange market might benefit significantly from such prompt responses and guidance.

So that they can get in touch with brokers if necessary, many regulatory agencies have them publicly provide their contact information. This can aid in ensuring that brokers face the consequences of their behavior and that clients have a means of seeking assistance.

A broker’s willingness to give out contact information is indicative of their professionalism and can go a long way toward establishing the latter’s standing in the industry.

AXOFA Regulation Status

This is the most crucial aspect of any broker. Even if a trader allows you to trade with zero spread, if they are unlicensed, it is futile to trade with them. AXOFA is located in Saint Vincent and the Grenadines (SVG). This is a red flag. In this region, the government does not regulate forex traders.

The small Caribbean nation is noted for its lax regulation of financial services. As a result, forex brokers operating from this country may be subject to less regulation than those working from countries with more developed regulatory systems. The possibility of dishonesty and fraud rises in such a situation.

If a trader has issues with an SVG-based forex broker, they may have few legal avenues. This is because forex broker regulators in this jurisdiction may lack the authority and resources of their counterparts in other, more established countries.

Some investors might be reluctant to work with FX brokers based in Saint Vincent and the Grenadines due to the jurisdiction’s reputation. Many people have accused several forex brokers in this country of fraud and other unethical conduct, which might tarnish their reputation.

Trading Conditions

The broker’s spread, minimum deposit, commission charges, and leverage are crucial. These are some of the parameters traders look for. This broker offers some attractive conditions.

The spread ranges from 0 to 1.6 pips. This is quite attractive, especially for new traders. The concerning thing about the broker is that they offer a leverage of 1:1,000.

Traders can easily blow their accounts with such conditions. Many regulators like FCA allow reasonable leverage of 1:30. This way, traders can minimize their losses significantly.

Although the broker offers a 10% bonus when you deposit, it gets canceled if you try to withdraw it. This means the broker is discouraging cashing out. The bonus can only be used for trading and only acts as bait.

AXOFA Deposit and Withdrawal

Traders can deposit via MasterCard, VISA, Wire Transfer, and Cryptocurrencies. The minimum deposit is $1. Many dubious brokers require traders to deposit through cryptocurrencies because it favors them.

Scam brokers know that cryptocurrency transactions are irreversible. Also, some shady brokers make it extremely difficult for traders to withdraw profits. They may ask for other charges they had not indicated when the trader opened the account.

What to Do if You’re a Victim of AXOFA.com

If AXOFA has stolen your money or made it difficult to access your funds, report them and start the recovery process. Register your case with our money recovery services, and we will guide you through the recovery process. Your funds are not safe with this unregulated scam broker, and it’s essential to start the recovery process before it’s too late.

Final Verdict

AXOFA is a typical scam broker. Like many other shady firms, this one leaves much to be desired. It has not included a lot of information to prove its validity. It is also located in a region notorious for harboring scam brokers. Due to these factors, we conclude they are scammers.

If you wish to trade the forex market, train intensively and work only with licensed forex brokers. These firms have a proven track record and positive customer reviews. They are also easy to reach in case you have any questions or concerns. In the meantime, stay away from AXOFA.